Securities Fraud Cases

An enrollment statement will be regarded reliable only regarding the securities specified therein as proposed to be provided. However, during this very same duration, the equally remarkable actual or pending bankruptcies of WorldCom, a long-distance telecoms company, and also Tyco, a varied tools supplier, influenced the material of the regulations. The provisions of SOX have significantly transformed SEC disclosure needs. Every one of the SEC’s disclosure demands have legal authority, as well as these guidelines and also regulations are subject to changes and also changes with time. Some adjustments are made as the outcome of new audit regulations adopted by the primary rule-making bodies of the audit career.

The Commission can accredit the team to file a case in government court or bring a management action. People and also firms charged often choose to settle the situation, while others oppose the fees. FINRA, a self-regulatory company, promulgates regulations that regulate broker-dealers and also certain other experts in the securities industry this Denver entrepreneur. It was formed when the enforcement departments of the National Association of Securities Dealers, currently FINRA, as well as of the New York Stock Exchange combined right into one organization. FINRA, like the stock exchanges as well as the Securities Investor Defense Firm, is looked after by the SEC, and generally FINRA’s rules go through SEC authorization.

The Top 16 Sorts Of Securities Fraud You Should Stay Clear Of.

The Securities Act of 1933 was the initial government regulation made use of to manage the stock market. The act took power away from the states as well as place it into opportunities of impact the hands of the federal government. The act likewise produced a consistent collection of regulations to secure investors versus fraud.

The Exchange Act likewise allows investors to take legal action against market participants who have actually defrauded them. These registration documents help the SEC keep track of the marketplaces for trading task that might suggest that market individuals are going against securities regulations. The Commission makes this details offered to all investors with EDGAR, its on-line declaring system. The SEC implements legal disclosure needs bringing enforcement activities versus business that share deceitful or incomplete details in violation of federal securities laws.

Truths are developed to the fullest level possible through casual query, speaking with witnesses, analyzing brokerage documents, assessing trading data, and also other methods. As soon as the Compensation concerns a formal order of examination, the Division’s team might compel witnesses by subpoena to testify and produce publications, documents, as well as other pertinent documents. Following an examination, SEC staff provide their findings to the Compensation for its testimonial.

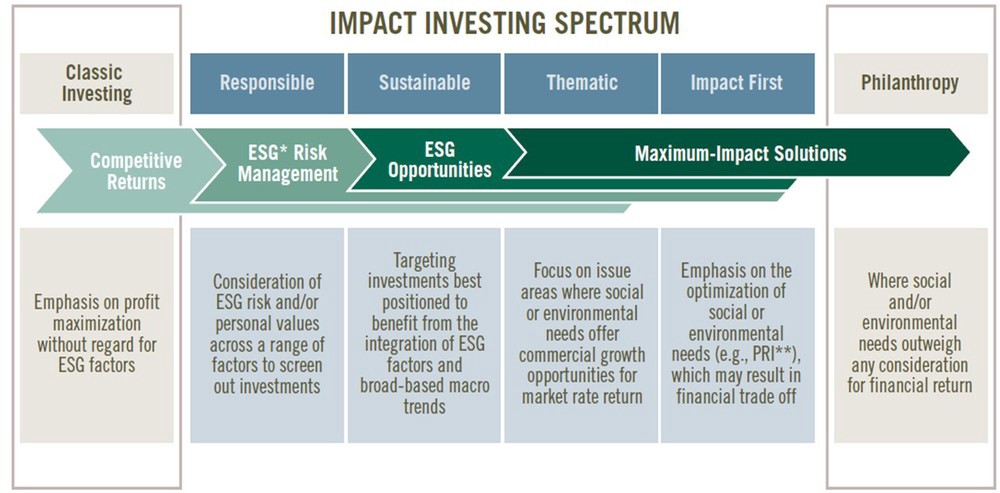

- Making use of hedge funds in monetary profiles has actually expanded substantially considering that the begin of the 21st century.

- The manager of a private equity fund, called the general partner, invests the capital increased from LPs in private business or other possessions and also handles those financial investments in behalf of the LPs.

- A hedge fund is simply an elegant name for an investment collaboration that has freer rein to invest aggressively and in a larger variety of economic items than most shared funds.

- Private equity companies raise resources from a range of institutional and also specific investors.

Is hedge fund illegal?

There have been a number of scandals involving hedge funds over the years. Most hedge funds are well run and do not engage in unethical or illegal behavior. However, with intense competition and large amounts of capital at stake, there are less than scrupulous hedge funds out there.

Nebraska Guy Banned From Selling Securities In Iowa.

The Economic as well as Threat Analysis Department was produced in September 2009 to incorporate financial economics and strenuous data analytics into the core objective of the SEC. The Department is involved across the entire range of SEC activities, consisting of policy-making, rule-making, enforcement, as well as examination. As the company’s “think tank,” DERA depends on a range of scholastic disciplines, measurable and also non-quantitative approaches, and also knowledge of market establishments and also methods to help the Compensation method complicated matters in a fresh light. DERA likewise helps in the Compensation’s efforts to determine, evaluate, and respond to threats and fads, including those associated with brand-new financial items as well as methods. Through the variety and nature of its activities, DERA serves the critical function of advertising collective initiatives throughout the firm as well as breaking through silos that could or else limit the influence of the firm’s institutional know-how.

While financier defense has actually thus been cited as a reason to unify corporate and also securities law, my write-up makes the novel disagreement that investor defense gives a theoretical framework for withstanding such marriage. The financier protection debate is correct in that both company as well as securities legislation secure investors, yet the debate as currently created is as well imprecise in setting apart between the ways in which investors need defense. A more nuanced conception of financier security would certainly distinguish between 2 phases of the common investment decision. The very first associates with the purchase of the security, where the trading investor is largely concerned concerning paying a fair cost. The 2nd associates with the duration when the capitalist possesses the protection when he is vulnerable to brand-new company misconduct that reduces the worth of the safety and security.

Investment Banking Vs Private Equity Video Clip.

The Securities and Exchange Commission, or SEC, is an independent federal regulatory agency entrusted with securing investors and capital, supervising the stock exchange and also recommending as well as imposing government securities laws. Prior to the SEC’s production, oversight of the sell supplies, bonds as well as various other securities was practically missing, which brought about widespread scams, expert trading and other misuses. The SEC was produced in 1934 as one of Head of state Franklin Roosevelt’ sNew Dealprograms to help combat the destructive financial effects of the Great Anxiety and protect against any type of future market calamities.

Significant pieces of legislation, such as the Securities Act of 1933, the Securities Exchange Act of 1934, and also the Investment Company Act of 1940, supply the framework for the SEC’s oversight of the securities markets. These statutes are extensively drafted, establishing standard principles and also purposes. Then, as the securities markets progress technically, increase in dimension, as well as use new services and products, the SEC participates in rulemaking to maintain reasonable and also organized markets as well as to safeguard investors by changing regulations or developing brand-new ones. The affixing of any signature without the authority of the supposed signer will constitute an infraction of this subchapter.