The siloed operations and lack of transparency in the finance market have actually normally rollovered into impact investing, however the pandemic may change that, she stated. Still, investors will be worried about liability danger, so it will be important to establish trusting relationships that make sense, Shields added.” This pandemic is requiring a lot of industries to think differently about boundaries and functions and why they have specific procedures,” she said.

The business has actually released a pipeline of about 100 startups that are reacting to the crisis and are searching for investment – Tyler T. Tysdal. The union, a group of more than 20 investors, is wanting to invest about $500,000 in the next few months, though the coalition is developed to scale which number may go up, stated Andrew Hobbs, Village Capital’s supervisor of product and innovation strategy.

It is thinking about how an expedited variation of that system might be utilized for the COVID-19 union, which could help include due-diligence capability to the coalition’s investors so that more deals can get done if the partners are open to it, Hobbs said. The crisis has sped up some things that were currently taking place, and Hobbs hopes the coalition will make it apparent that collaboration is useful and more of it ought to be performed in the long term, he stated.

The coronavirus has actually exposed the reality that the international capital system is generally broken, and while that may present a chance, the system still has “extraordinary inertia,” said Cathy Clark, faculty director of the Center for the Development of Social Entrepreneurship at Duke University’s Fuqua School of Business. “This crisis will have an extensive influence on economic development typically and specifically how we think of the distinction between organisation and investing in society and the world,” stated GIIN’s Bouri.

In response to this shock, the company requires to translate high-level intentions into financial investment opportunities and measurable results, Bouri stated.” This pandemic is forcing a lot of markets to think in a different way about limits and functions and why they have particular protocols.” Meredith Shields, director of impact investing, Sorenson Impact FoundationThere is a chance for this moment to drive major changes in the financial system, said Ronald Cohen, chairman of the Worldwide Steering Group for Impact Financial Investment, who has actually been advocating for a shift to a monetary system that takes risk, return, and impact into account.” It’s going to give the motion a really big push,” he said (Tyler T. Tysdal).” Crisis creates a great deal of pressure to make certain cash delivers what it’s expected to deliver.” If the more than $30 trillion in professionally managed properties that are invested to minimize harm could be pushed to determine impact, which investors might then use to evaluate their worth, the impact would be transformative, Cohen stated.

While that may be an ambitious goal, there are other potential tangible effects of the manner ins which the crisis has actually required collaboration and altered practices. When investors have actually seen the advantages of higher cooperation, perhaps it will take place more. There might also be a chance to increase financial investment in business that are more diverse and not always right down the roadway – Tyler T. Tysdal.

Please use the sharing choices on the left side of the short article. Devex Pro customers might share up to 10 short articles each month using the Pro share tool ().

Tysdal Lone Tree

Diana LiebermanThe Journal of Investing, Winter 2020A variation of this paper can be discovered hereWish to read our summaries of scholastic finance papers? Take a look at our Academic Research Insight categoryCan we do impact investing that is both good for us and tastes better? In the past, if a financial investment had favorable non-financial outcomes (favorable impact), a return compromise was anticipated.

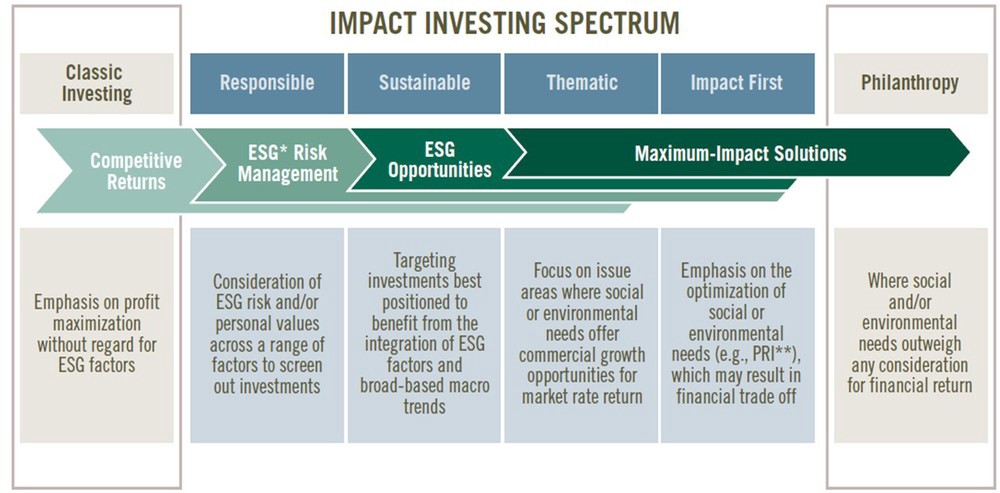

Clearly not all well balanced meals are tasty. Similarly, incorporating these aspects does not always guarantee higher returns. The author addresses four essential questions: What is Impact Investing?What are the return and impact spectrum?Where does Impact Investing stand today?What is Impact Investing 2.0? If you ask 5 individuals what is, you will likely get five various answers – Tyler Tivis Tysdal.

He used this term during a conference regarding kinds of financial investments with more than a single aim that would leverage capital in a method beyond what conventional grants might (Greene 2014). Foundations pursue their objectives with grants, Program Related Investments (PRIs) where an investment is expected to be paid back without any (or low) interest, and with Mission Related Investments (MRIs), which have a modest return expectation.

The investment-oriented advancement began with socially accountable investing (SRI). SRI Investing occurs when: 1) Investors would leave out particular industries or business that, from a social or ecological perspective, were felt to be undesirable; 2) Large shareholders or groups of shareholders can encourage business obligation and prevent unsustainable or unethical practices (investors advocacy) (Tyler T. Tysdal).

ESG investing expands opportunities beyond negative screening. Rather than consisting of or omitting a company based upon its industry or item line, an ESG analysis takes a look at a business through a more comprehensive lens by consisting of the company’s ESG practices. ESG investing began its development towards impact investing when it embraced an economic and monetary reason for incorporating the ESG factors into the investment choice (Tyler T. Tysdal).

For circumstances, business actively working to reduce their carbon footprint probably will have lower future energy expenses compared to companies that do not prioritize energy performance. Research studies (here and here )show that board diversity permits divergent views, which create more well-rounded decisions and hence a more effective governance procedure (Tyler T. Tysdal).

As Exhibition 3 programs, on one end, no return is expected, as with grants or PRIs, and on the opposite end of the spectrum, the financier expects an above-market return. Clearly, the humanitarian capital is the only funding source without any return expectation and is relatively unlikely to seek above-market returns – Tyler Tivis Tysdal. Tyler Tivis Tysdal.

Fund Manager Partner

Some impact investors accept below-market returns, anticipating a social return that will compensate for the decrease. The appropriate amount of compromise between investment return and social return differs depending on the investment and the financier (for example, microfinance). Just recently, increasingly more impact investors are seeking to achieve market and above-market returns.

Lastly, financial investment methods wanting to carry out better than the market will integrate ESG aspects as a theme due to the fact that investors see added worth in them. Just as there is a return spectrum for impact investing, there also is an impact spectrum. Exhibition 4 reveals that this spectrum ranges from having an unfavorable impact to having a high favorable impact, together with the possibility of having no meaningful or recognized impact.

A low impact investing example is a solar bond. A modest impact investing example is a property example of retrofitting an existing building to be energy efficient and supply a healthier and community-oriented workplace. Finally, a high impact investing example is a Kenyan solar energy personal company offering house solar systems in Kenya, Tanzania, and Uganda.